Labuan Income Tax Act

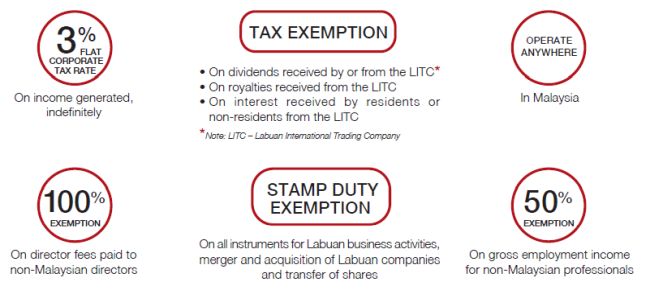

On the other hand if your business is conducting Labuan non-trading activities our international clients will continue to enjoy legally tax-exempt status and be subject to 0 corporate income tax. Resident companies in Labuan are subjected to a Corporate Income Tax rate of 3 on annual audited taxable net income under Labuans Tax Regulations.

A Guide To The Gift Programme Finance And Banking Malaysia

For the purpose of benefiting from the treaty provisions a Labuan company can opt to be taxed under the Malaysian Income Tax Act.

Labuan income tax act. The 2018 budget introduced some changes to the tax treatment of Labuan entities effective as from 1 January 2019. Foreign sourced income received in Malaysia by resident individuals are tax-exempt. Income from intellectual property assets held by a Labuan entity is subjected to the prevailing rate under the Income Tax Act 1967 of 24.

Malaysia Labuan has DTAs with 70 countries Accurate listing. 1st October 1990 PUB 5891990. The Labuan Business Activity Tax Act 1990 LBATA was amended via the Finance Act 2018 which came into force on 27 December 2018.

In most cases this applies to those Labuan companies that are engaged in business with Malaysian companies also referred to as non-Labuan business activities. Labuan IBFCs legal framework comprises eight Acts which empower Labuan FSA and provide for the legal establishment of Labuan entities operating in the Centre. ACT 445 LABUAN BUSINESS ACTIVITY TAX ACT 1990 An Act to provide for the imposition assessment and collection of tax on a Labuan business activity carried on by a Labuan entity in or from Labuan and for matters connected therewith.

Individuals Individual residents in Labuan with income accruing in or derived from Malaysia are subject to tax. Labuan entities carrying on a Labuan trading activity no longer have the option to elect to pay tax of RM20000 meaning that all Labuan entities which carry. Under the revised Section 2B 1 b of the Labuan Business Activity Tax Act 1990 LBATA a Labuan entity must for the purpose of the Labuan business activity have an adequate number of full time employees and an adequate amount of annual operating expenditure in Labuan as specified under the Labuan Business Activity Tax Requirements For Labuan Business Activity Regulations.

A Labuan entity also may irrevocably elect to be taxed under the ITA rather than the LBATA. Please refer to F AQ on Labuan Company Tax for more information. A separate tax act called the Labuan Business Activity Tax Act was introduced in 1990 for governing tax imposition on Labuan entities involving in business activities.

Subsidiary legislation of the Labuan laws comprise Orders and Regulations made under the respective Labuan laws which have a legislative effect and are to be read together with the principal legislation. In Malaysia income tax is imposed on the basis of the 1967 Income Tax Act. 05 Can a Labuan company elect to be taxed under Income Tax Act 1967.

Double Taxation Agreement is an agreement between two countries seeking to avoid double taxation. Income Tax Act 1967 - Max tax. The account has to be audited and file to the local IRB annually.

The LHDN Labuan also to act as agent of the Government and to provide services in administering assessing collecting and enforcing payment of income tax petroleum income tax real property gains tax estate duty stamp duties and. For more info please click here. An activity carried on by a Labuan entity that is not a Labuan business activity is taxable under the Income Tax Act 1967 ITA.

That said it goes without saying that there are stringent requirements to be complied with prior to the enjoyment of the special tax rate. Labuan company that dealt with Malaysia residents individual or corporate that have opted to be taxed under the Malaysia onshore Income Tax Act 1967 with a tax rate of 24 on net profit. Labuan Companies Act 1990 Act 441 - The Act that governs.

The rate of tax imposed is 3 of audited net profits for trading activity and zero percent for non-trading activity provided that the Labuan entities are in compliance with the tax substantial activity requirements. As per the provisions of the act Labuan entities could opt to pay either a flat RM 20000 or at the rate of 3 percent tax rate. The Labuan Income Tax Office LHDN Labuan is one of the main revenue collecting agencies of the Ministry of Finance.

Labuan Business Activity Tax Act 1990 - Labuan corporate tax 3 tax if substance are fulfilled 24 tax if substance are not fulfilled ITA Act Income Tax Act 1967 - 24 corporate tax if source of income is derived from Malaysia. Any income incurred from intellectual property rights is now subject to tax under the Malaysian Income Tax Act 1967 ITA instead of the LBATA. Income derived from royalty or other income derived from an intellectual property right shall not enjoy LBATA tax and is now subject to tax under the Malaysian Income Tax Act 1967 ITA.

25 for source of income from Malaysia only. Malaysian entities making transactions with a Labuan entity are now entitled to an income tax deduction on any expenditure that occurred although this is limited to a rate of three percent. As a company incorporated under the Labuan Companies Act 1990 it is generally only required to pay taxes at a rate of 3 as compared to the standard rate of 24 for a typical Sdn Bhd.

The rate of tax ranges from 0 to 28 for resident individuals and a flat rate of 28 for non-resident individuals. The definition of Labuan business activity was amended to remove Malaysian ringgit restrictions or restrictions on dealing with Malaysian residents. Key changes under the LBATA are as follows.

Presentation Labuan International Banking Tax Perspectives

Labuan Developments Kpmg Malaysia

Komentar

Posting Komentar