Labuan Tax Filing Deadline 2021

The financial year end for all Labuan companies is usually fixed on 31st December each year unless you apply for a different date. Mon - Thu.

Expat Secrets How To Pay Zero Taxes Live Overseas Make Giant Piles Of Money In 2021 Expat Business Class Travel Overseas

This technique of e-filing is now well-liked by taxpayers because of its ease and user-friendliness.

Labuan tax filing deadline 2021. 87000 W P Labuan. However when filing the Form C by 31 October 2021 statutory deadline the relevant constituent entities would still need to complete the CbCR Notification particulars within the Form C for YA 2021. Tax return is up to date till year assessment 2019.

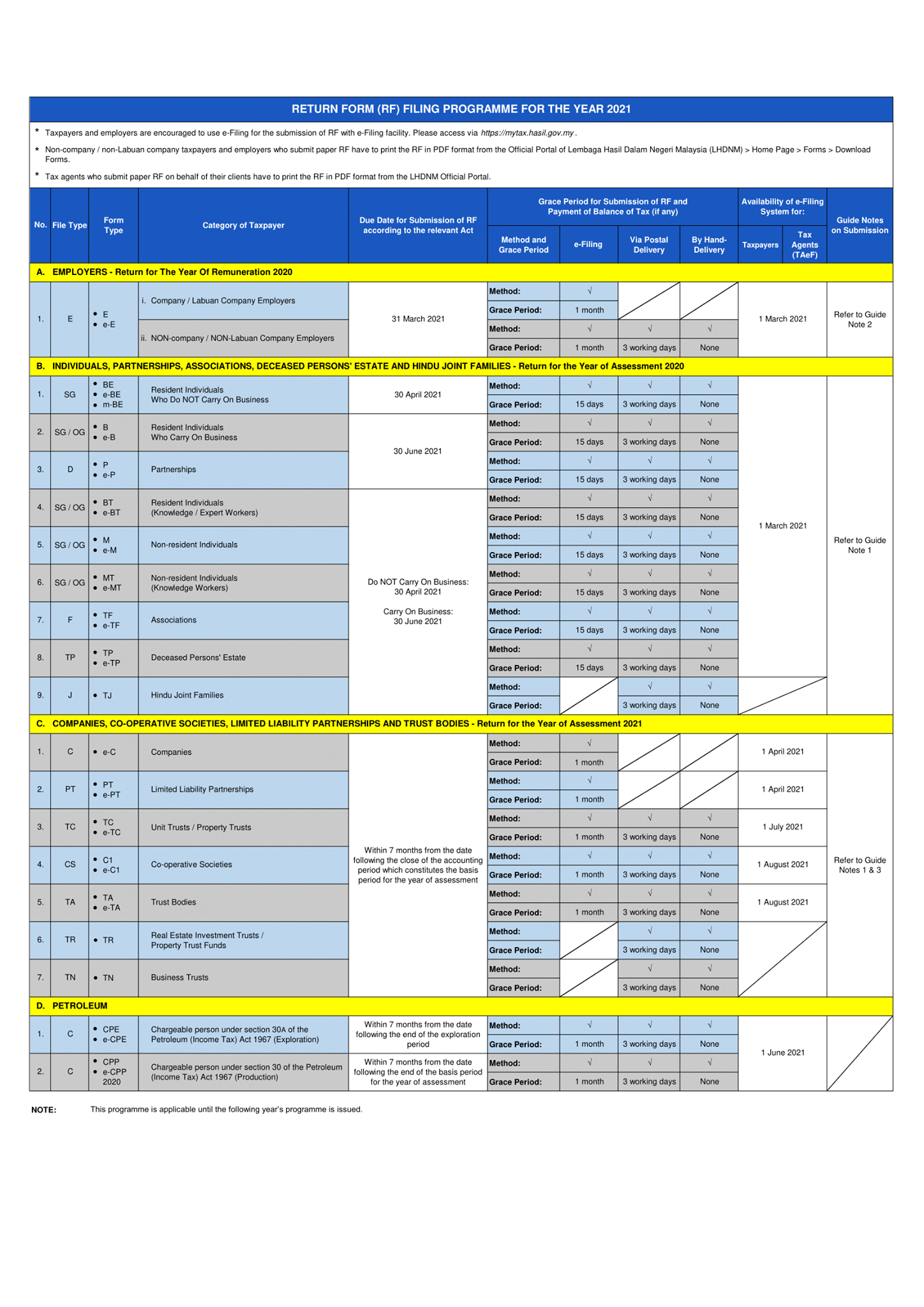

Quotation No Project Name Deadline and Place of Submission RFQ 0025 Labuan FSA Tax Filing Requirements Under the Income Tax Act 1967 ITA 25 May 2021 Labuan FSA Level 17 Main Office Tower Financial Park Complex Jalan. The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021. Due to the COVID-19 pandemic the federal government extended this years federal income tax filing deadline from April 15 2021 to May 17 2021.

087 - 415 385. The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals. Just another site.

800am - 1215pm 245pm - 500pm. Less then minute ago by 1 by 1. We will notify our clients from January 10 every year.

The due date for submission of Form BE for Year of Assessment 2020 is 30 April 2021. The Latest Labuan Tax 2019 changes have taken effect since 1st January 2019 Year Assessment 2020 hence the new corporate tax filing are as follows. LABUAN FSA TAX FILING REQUIREMENTS UNDER THE INCOME TAX ACT 1967 ITA Quotation Requirements 1.

Deadline for Income Tax Return in 2021 Whether it is working or doing business for tax safety the most important thing that cannot be ignored is tax declaration and tax payment From March 1st the income tax of 2020 income must be reported. These payments are still due on April 15. Labuan tax filing deadline 2021.

Late reporting will be fined. Submitted by 31 March 2021. 30062021 15072021 for e-filing.

If the reporting year-end is 30 June 2021 YA 2021 then the CbCR Notification would be submitted through the Form. The following are the deadlines for tax filing. The deadline for filing the form is November 30 2021 for the 2021 year of assessment.

To get to know the latest 2021 Labuan tax changes and law in great detail please visit here. Estimated tax payment due April 15 Notice 2021-21 issued today does not alter the April 15 2021 deadline for estimated tax payments. Labuan Business Activity Tax Automatic Exchange of Financial Account Information Regulations 2018 CRS Regulations.

Grace period is given until 15 May 2021 for the e-Filing of Form BE Form e-BE for Year of Assessment 2020. The remaining balance of 40 must be applied straight to 28102020 one time application and must be submitted before or up to 15072020. In accordance with Labuan Financial Services Authority Labuan FSA it is mandatory for corporate entities partaking in businesses within the jurisdiction to file annual tax returns electronically by the last business day of March following the fiscal year ending on 31 st However businesses can request for an extension until the end of May subjected to approval.

The Inland Revenue Board IRB has issued a letter dated 11 March 2021 to the Association of Labuan Trust Companies ALTC to confirm that Labuan entities would be granted an automatic extension of time until 31 August 2021 to submit their tax returns for YA 2021 based on the financial year ended in 2020. For all Labuan Companies that comply with the substance requirements the corporate tax rate will be 3 on net audited profits. 800am - 100pm 200pm - 500pm Friday.

This extension is automatic and applies to filing and payments. If a taxpayer furnished his Form e-BE for Year of Assessment 2020 on 16 May 2021 the receipt of his RF shall be considered late as from 1 May 2021 and penalty shall be imposed under subsection 1123 of ITA 1967. So if you owe taxes for 2020 you have until May 17 2021 to.

Home All posts Uncategorized labuan tax filing deadline 2021. For Labuan Company corporate tax annual filing the assessment will be based on the activities. Taxes must be paid as taxpayers earn or receive income during the year either through withholding or estimated tax.

087 - 595 300. 4 Your income tax refund will be done through Electronic Fund Transfer EFT to your bank account. Only applicable for Labuan Entity that has no tax outstanding including compound and tax.

The Labuan Income Tax Office LHDN Labuan is one of the main revenue collecting agencies of the Ministry of Finance. For Labuan Company corporate tax annual filing the assessment will be based on the activities carried out during the year.

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Income Tax Malaysia 2021 Deadline

Komentar

Posting Komentar