Examples Of Labuan Trading Activity

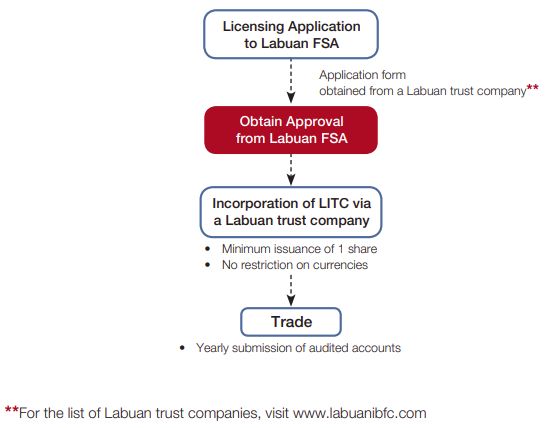

Labuan International Commodity Trading LITC is for traders of physical products and related derivatives that primarily uses Malaysia as their base Eg Petroleum related liquefied natural gas LNG minerals agriculture refined raw materials chemicals base minerals coal. Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities.

A Guide To The Gift Programme Finance And Banking Malaysia

This means that all Labuan entities that carry on a Labuan trading activity and comply with the relevant economic substance requirements shall be.

Examples of labuan trading activity. Labuan entities carrying on a Labuan trading activity no longer have the option to elect to pay tax of RM20000. Allow a Labuan company to issue shares which may be divided into one. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity.

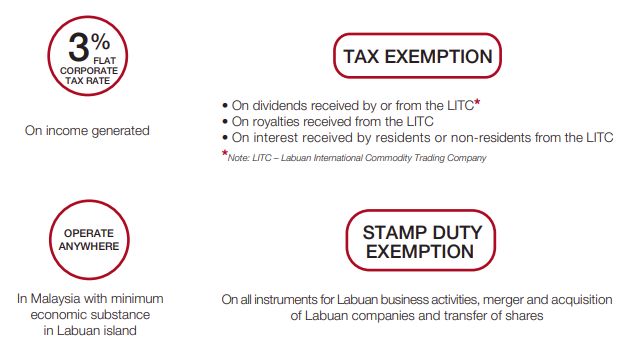

Trading activity of a Labuan Company is defined as carrying activities which include banking insurance trading management financing import export trading agency wholesaler consultancy and advisory. Broadening the scope of Labuan business activity to include shipping operations. The corporate tax will be 3 on profits with audit report required subject to complying with the latest substance.

Sample 1 Sample 2. Example question cerdik trading labuan ltd ct is. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

For Trading Company. For example Labuan companies are limited in terms of trading with Malaysian companies or residents. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity.

Buyers of call look for option profits from some probable advance in the price of specified stock with a relatively small investment compared with buying the stock outright. Where Labuan Company carries on both trading and non trading activities it is deemed to be carrying on trading activities. Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

Means an activity relating to the holding of investments in securities stock shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf. The letter states that Labuan entities carrying on other trading activities which were classified under Code 23 for Labuan Business Activity Tax Act 1990 LBATA filing purposes will be required to submit their income tax return forms ITRF under the ITA instead of under the LBATA. The maximum that can be lost is the cost of the option itself.

SUBSTANCE REQUIREMENT UNDER LBATA with effect from 1st January 2019 Pursuant to section 2B1 b of LBATA the Labuan entities shall for the purpose of the Labuan business activity have -an adequate number of full time employees in Labuan. Define Labuan non-trading activity. Example Question Cerdik Trading Labuan Ltd CT is trading in antiques It was.

Course Title ITA 1967. B Expansion of the list of Labuan entities that are subjected to substantial activity requirements to include Labuan entities that undertake pure equity holding activities 1 and Labuan entities that carry out administrative accounting and legal services including backroom processing payroll services talent management agency services insolvency related services and management. Pages 34 This preview shows page 8 - 18 out of 34 pages.

School University of Ottawa. Non trading activity which refers to the holding of the investment in securities stocks shares loan deposits and immoveable properties by an offshore company on its own behalf. Labuan Companies Act 1990 Removal of the requirement to obtain approval for dealings between Malaysian residents and Labuan companies.

The due dates for the submission of the ITRF under the ITA are. Labuan business activity means a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan excluding any activity which is an offence under any written law. - a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan - excluding any activity which is an offence under any written law.

Another important aspect refers to the fact that the Labuan jurisdiction is a very welcoming region for foreign investors as they are allowed to incorporate a company with 100 foreign ownership.

Labuan Company Formation Registration Cost Malaysia

Labuan Company Formation Business Incorporation Registration

Komentar

Posting Komentar